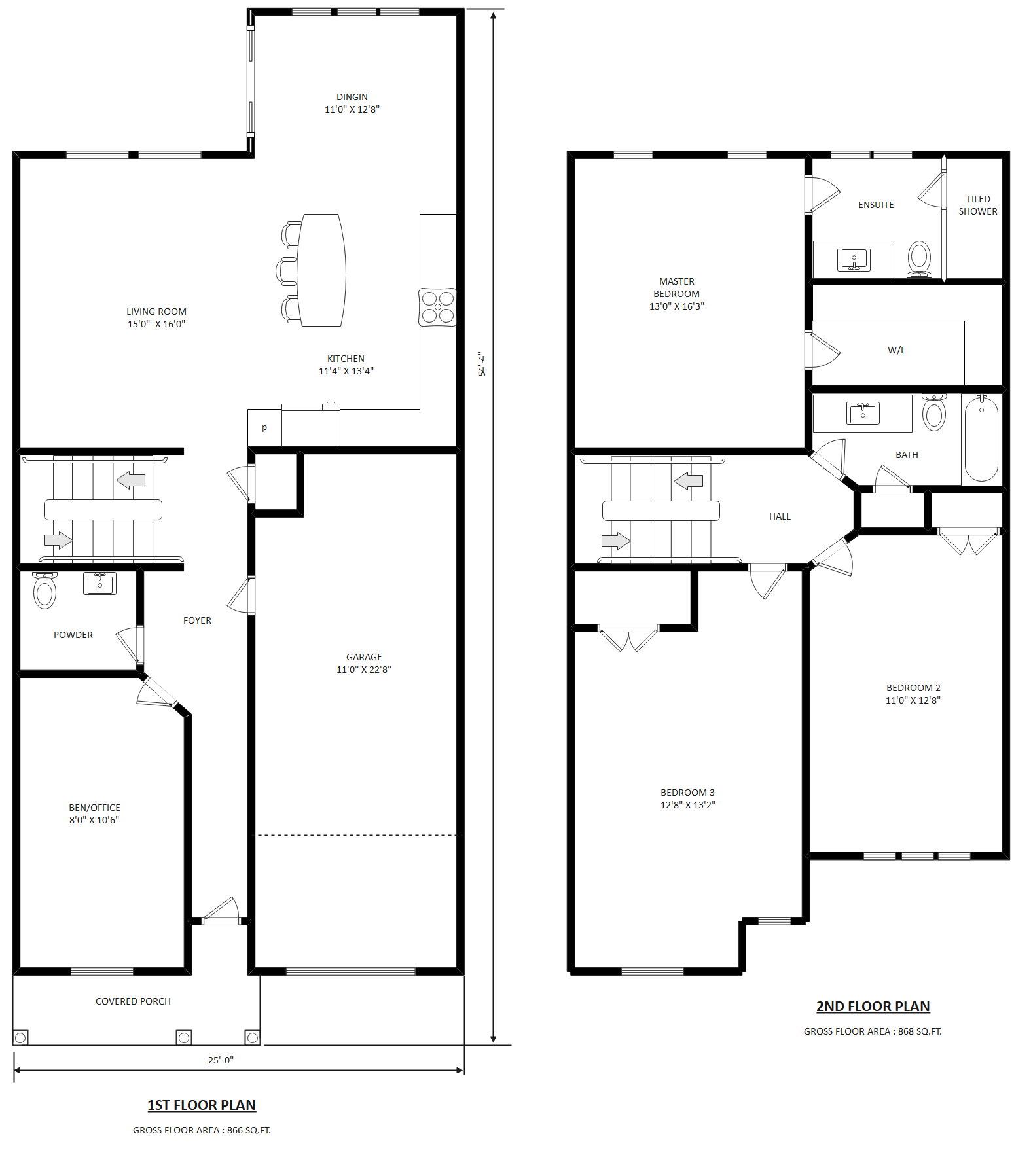

Modern 2 Story House Layouts Maximizing Space & Style

Embracing Vertical Living: The Allure of Two-Story Homes In the realm of residential architecture, two-story homes have always held a special allure. Offering a perfect balance of space, style, and…

Leafy Elegance Common House Plants for a Stylish Home

Green Beauties: Top House Plants for Every Home Indoor Oasis: Popular House Plants for Beginners Lush Living: Must-Have House Plants for Any Space Leafy Elegance: Common House Plants for a…

Natalie Walton Creative Visionary in Interior Design

Natalie Walton: Creative Visionary in Interior Design The Artistic Journey Begins Natalie Walton’s journey into the world of interior design is one of passion, creativity, and relentless pursuit of beauty.…

Log House Maintenance Tips for Preserving Your Timber Home

Subheading: Introduction Owning a log house is a dream for many, but it comes with its own set of responsibilities. Proper maintenance is essential to preserve the beauty and integrity…

Create a Tranquil Oasis with Indoor Creeper Plants

Indoor Creeper Plants: Creating Your Tranquil Oasis Embracing Nature Indoors In the hustle and bustle of modern life, finding moments of tranquility is essential for our well-being. One way to…

Innovative Design Renovation Solutions for Every Room

Innovative Design Renovation Solutions for Every Room Revitalize Your Living Spaces When it comes to home renovation, finding innovative solutions that breathe new life into every room is key. Whether…

Factors Influencing Home Renovation Costs 2022 Insights

Subheading: Economic Factors The economic landscape plays a significant role in influencing home renovation costs in 2022. Factors such as inflation rates, material availability, and labor costs all contribute to…

Elegance Defined Luxury House Interior Design Ideas

Elegance Defined: Luxury House Interior Design Ideas Aspirations of Luxury In the realm of home design, luxury represents an aspiration for sophistication, opulence, and refined taste. It’s about creating spaces…

Budgeting for Renovation Making Every Dollar Count

Introduction Embarking on a renovation project is an exciting endeavor, but it can also be daunting, especially when it comes to budgeting. However, with careful planning and strategic decision-making, you…

Elevate Your Roofing Game Advanced Frame Strategies

Introduction: When it comes to roofing, the frame is the backbone of the entire structure. Elevating your roofing game requires mastering advanced frame strategies that go beyond the basics. In…

:max_bytes(150000):strip_icc()/27-common-houseplants-hero-getty-1123-787605e2fbbe4362a67db8ac93c1be86.jpg)